About OPS

What kind of company is OPS?

OMNI-PLUS SYSTEM LIMITED(OPS) develops total supply chain solutions for Engineering plastics which are synthetic resins (materials) through 2 business operations.

OPS's 2 businesses

-

Distribution business

Distribution and sales of Generic and Specialty Engineering plastics materials -

Development and manufacturing business

Manufacture and compound of original Engineering plastics materials in accordance with customers' needs

※compound(mixing・coloring):adding characteristics and values (durability and heat resistance) and specific coloring to synthetic resin materials

Customers of OPS Engineering plastics products

Top multi-national brand manufacturers :

European home appliances manufacturer D, famous for vacuum cleaners;

American office automation equipment manufacturer H; Scandinavian telecommunication equipment manufacturer N; European medical

equipment manufacturer B and many others.

What are Engineering plastics?

Generic term for synthetic resins with high heat resistance and improved mechanical strength for use under harsh industrial conditions.

Engineering plastics are positioned between metal parts and Generic plastic parts enabling lighter weight and lower price. This is why many types have been developed and are used for variety of applications.

OPS’s Engineering plastics products are used in parts for home appliances,

vacuum cleaners, OA equipment, automobiles, cell phones, etc.

<Sales Breakdown by End use: FY2025.3 Results>

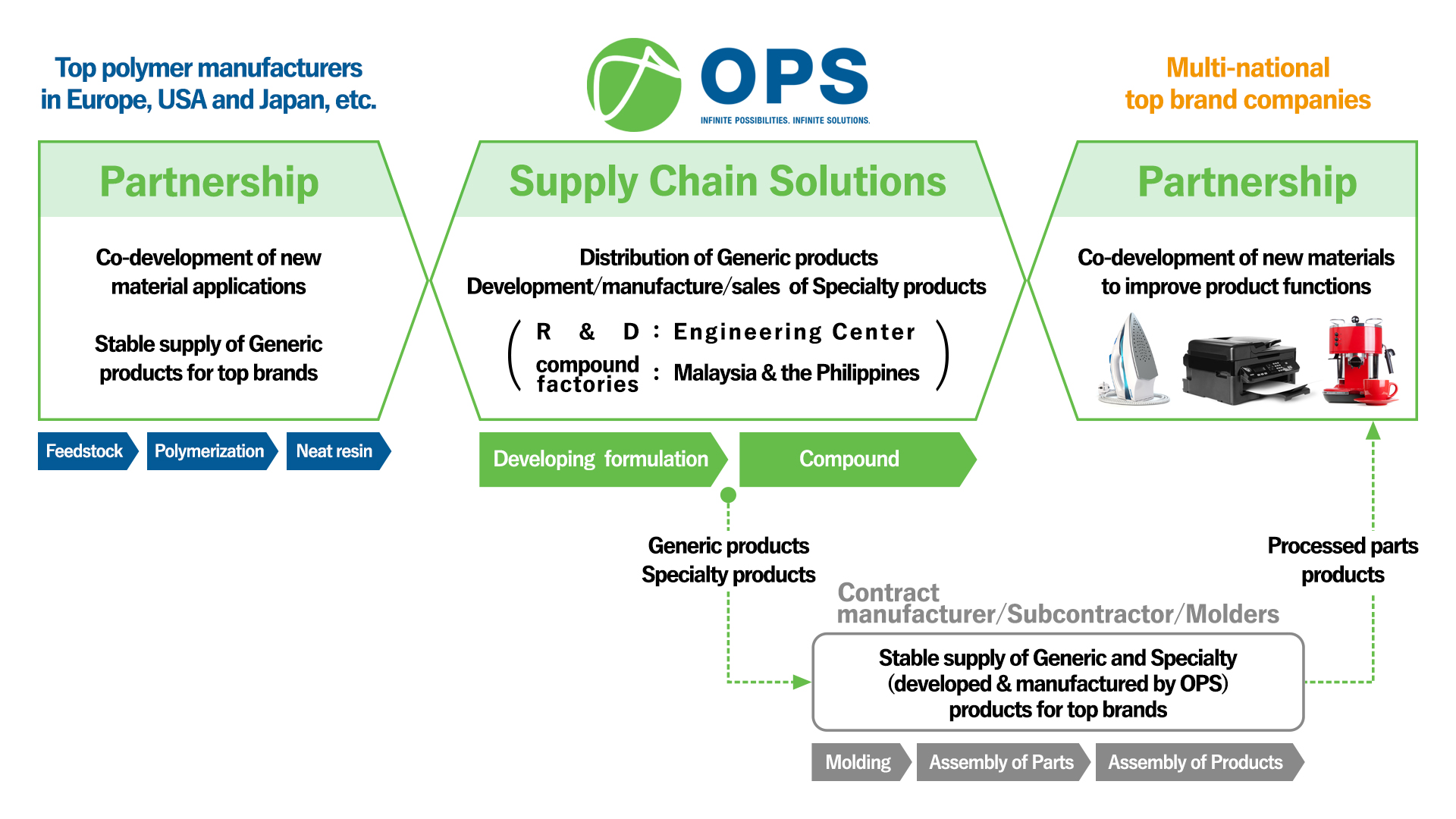

OPS's Business Model

- We can provide supply chain solutions from the polymer manufacturers (upstream) to the finished product (downstream) which is one of OPS's strengths.

- Stable supply of products for top brands through strong partnership with polymer manufacturers.

- Reliable supply of products through strong relationship with contract manufacturers, etc.

- We can respond to individual customer's needs, especially coloring to its specification. This is OPS's specialty and is one of the reason that makes us the customer's choice.

- R&D, Engineering Center is located next to the head office and the compound factories are in Malaysia and the Philippines.

Business development in ASEAN countries

Mainly in ASEAN countries, but recently expanding into Greater China

OPS's continuous growth

In the last five fiscal years, revenue has expanded 1.5 times (CAGR 10.5%).

In addition, total assets increased 1.7 times.

※CAGR:Compound Average Growth Rate (Average annual growth rate)

※Revenue, Profit for the year, Total assets in thousands of US$, Employees in persons

OPS’s 3 strengths

-

1. Partnership with top polymer manufacturers in Europe, USA and Japan

-

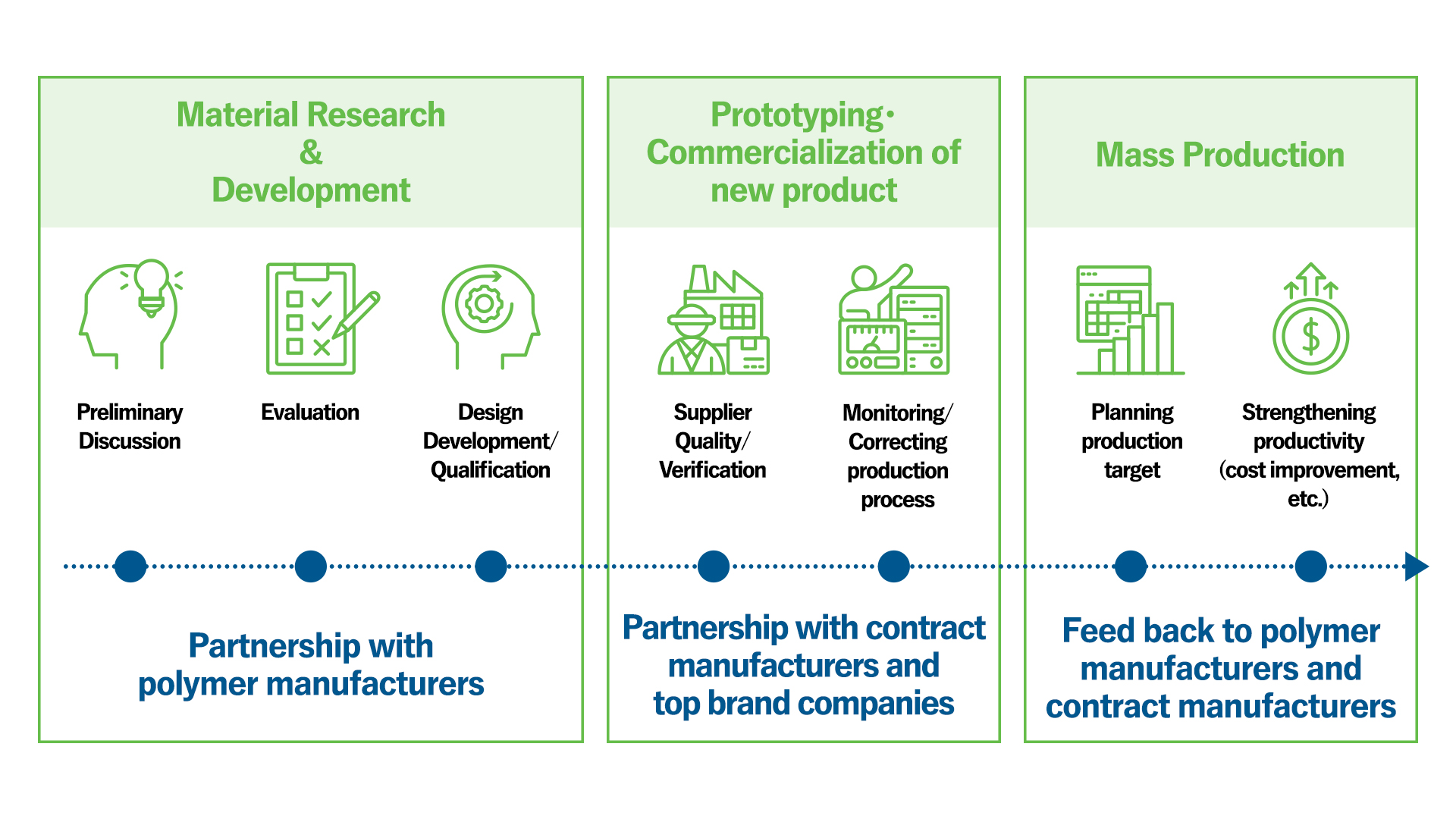

2. R&D capabilities and partnership with top brand companies

- Conducts joint R&D from the early stage of the customer's product life cycle

- Can respond to customer's needs including environmental, safety, technical and regulatory requirements

- Continuously follow the entire product development process

-

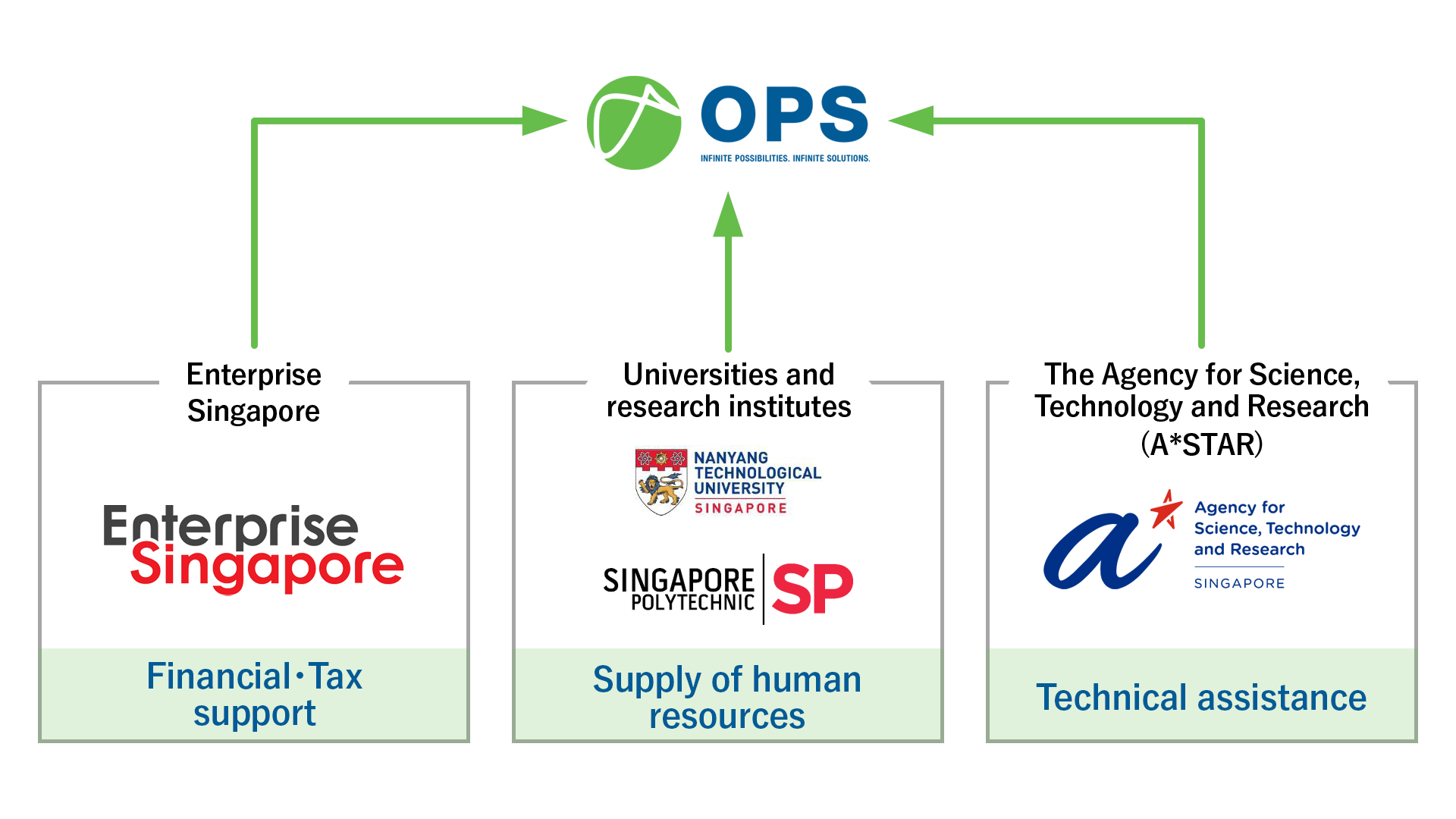

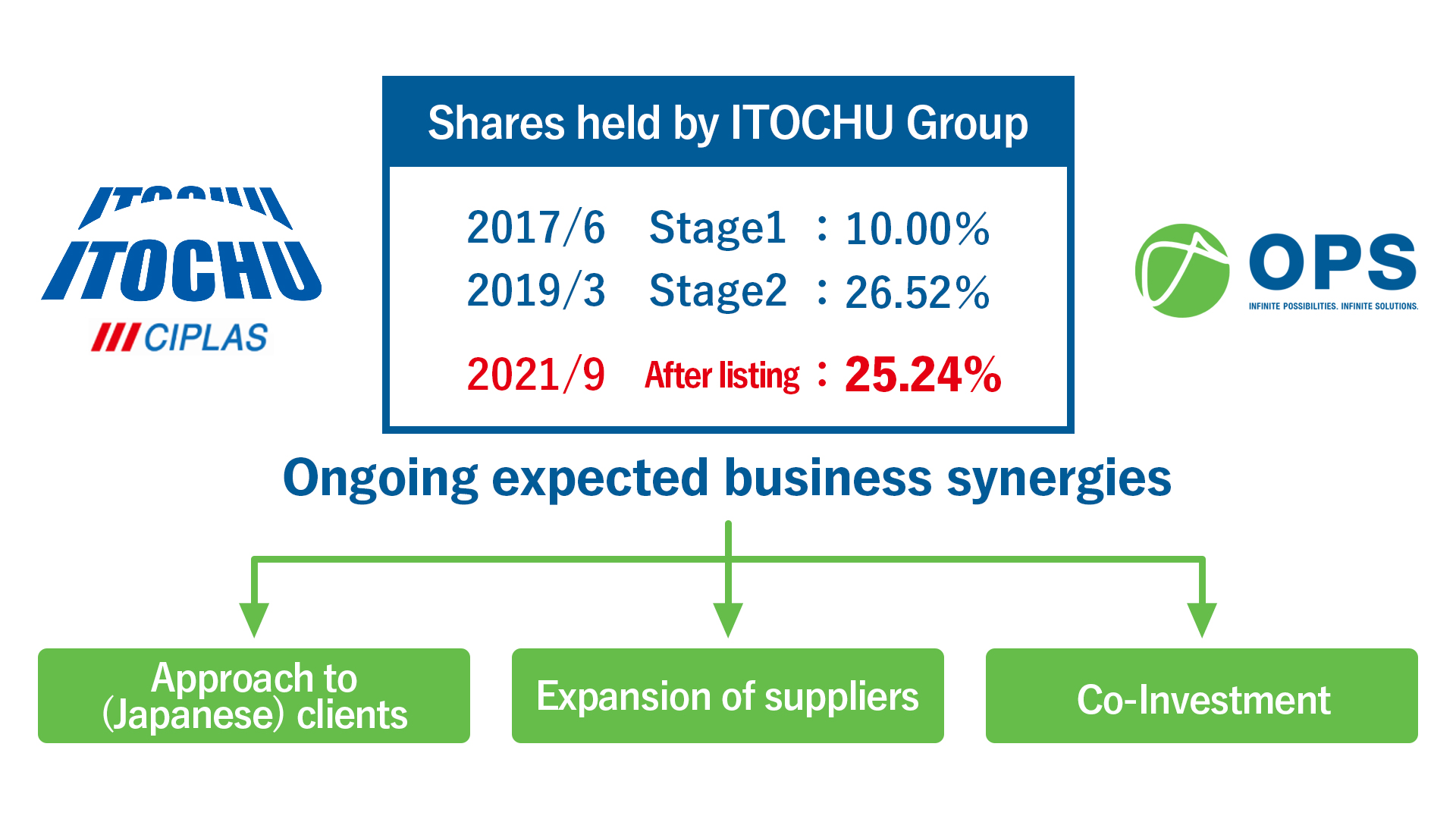

3. Strong support from strategic partners

- Multifaceted support and cooperation from the Singapore government

- Synergies from collaboration with ITOCHU Group:full-scale contributions to business from FY2022/3

- Multifaceted support and cooperation from the Singapore government

OPS's focused growth areas

In addition to our existing focus on ① Information and Telecommunications technology such as 5G, and ② mobility applications, represented by EVs, as growth areas we should focus on in the medium to long term, we have strategically positioned ③ Semiconductor-related fields and ④ Medtech as new priority areas.

Three sustainable solutions

We combine materials that utilize recycling technology, collaborate on the development of alternative materials, and even provide biodegradable products made from bamboo.

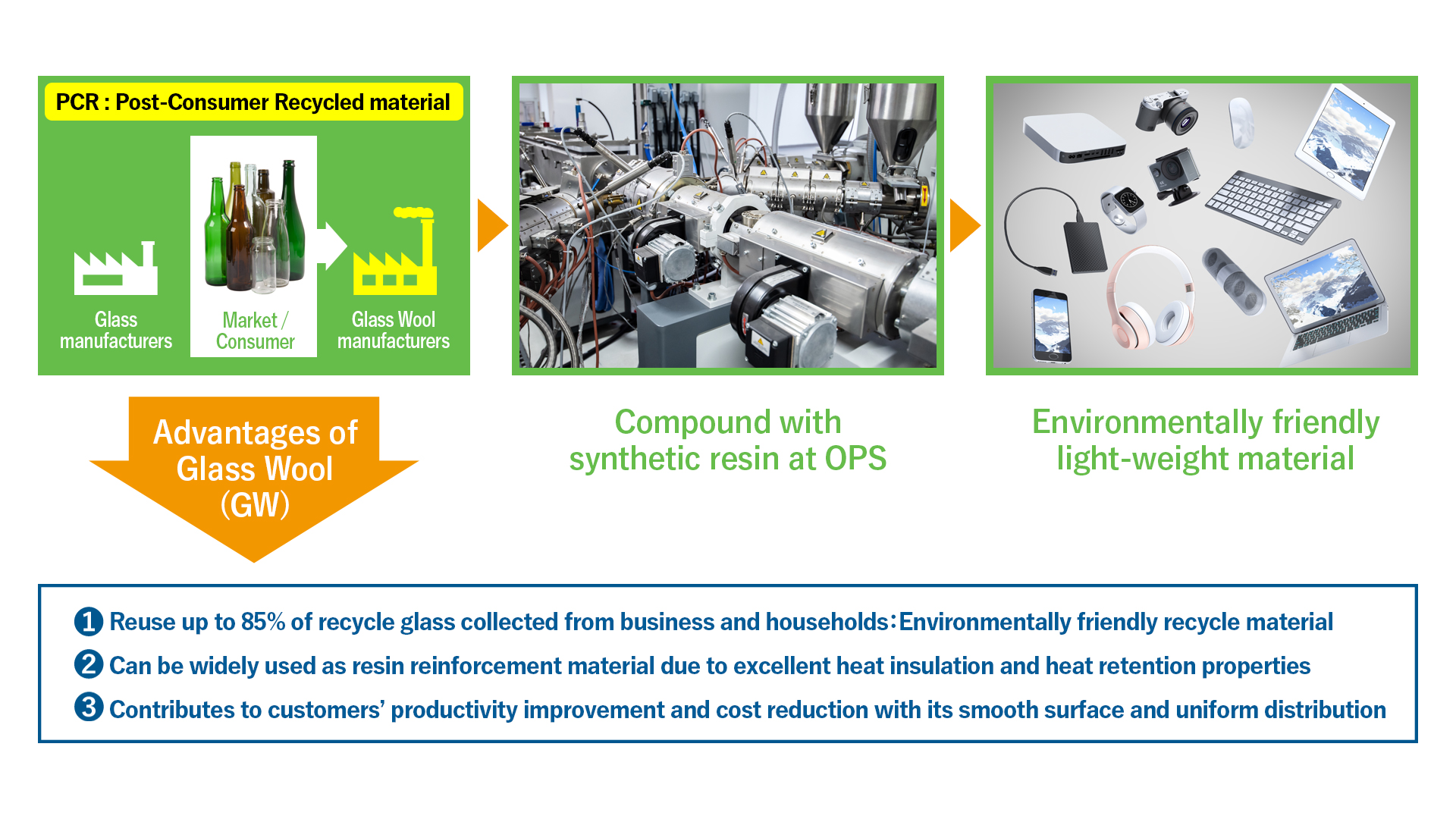

⓵Mixing with Glass Wool (GW), used recycle material

⓶Bio Polymer:Co-development of plastics alternative materials

Co-developing Biodegradable plastic that is eventually broken down into water and carbon dioxide by microorganisms in the natural world with Singapore Agency for Science, Technology and Research (A*STAR)

⓷Biodegradable products made from bamboo

Providing a better, more sustainable option without sacrificing the convenience of traditional disposable plastic products

Return to JDR beneficiaries

Dividend Policy:To maintain stable dividends while strengthening its operating base and financial structure with respect to profit distribution

We return stock dividends to the beneficiaries of Beneficial Securities in the Securities Trust (JDR) as distributions.

| Distribution payments for the last three fiscal years | Payment Date | Unit Price (per JDR) | Dividend Payment Ratio* |

|---|---|---|---|

| March 2023 Interim | 10 February 2023 | 19 YEN | 11.9% |

| March 2023 End of period | 18 October 2023 | 13 YEN | 19.8% |

| March 2024 Interim | 15 February 2024 | 21 YEN | 18.1% |

| March 2024 End of period | 18 October 2024 | 12 YEN | 18.0% |

| March 2025 Interim | 13 February 2025 | 28 YEN | 22.8% |

| March 2025 End of period | 17 October 2025 |

*The dividend payout ratio is calculated on dividends in ordinary shares.